2023

Benefits at a Glance

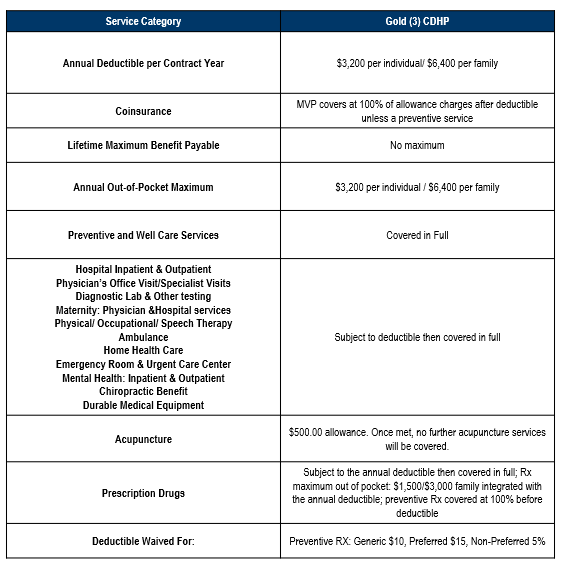

Your Medical Benefits

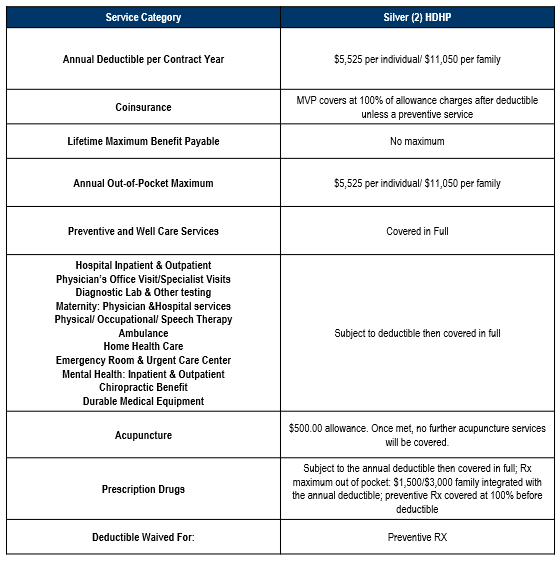

One Credit Union offers one (2) medical plans to its eligible employees. Coverage is provided through MVP Health Care. Below is information on the benefits.

Summary of Benefits and Coverages

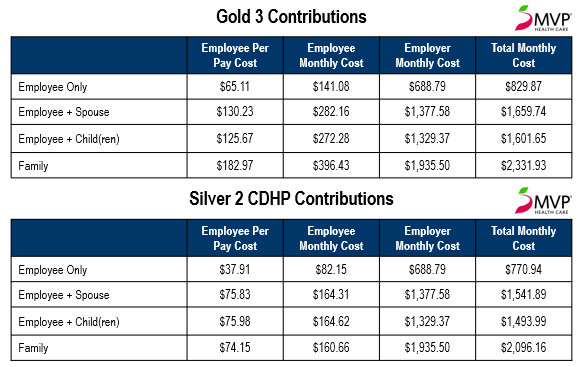

Contributions

Eligibility

Eligibility is date of hire for employees scheduled to work 30 or more hours per week. One Credit Union will pay 83% of the premium. Employees declining coverage will need to complete a waiver of group health insurance benefits form.

NOTE:

Effective for the dates of service beginning on May 12, 2023, standard cost-shares, including deductible costs, for Commercial fully insured plan members will apply the following:

- COVID-19 diagnostic lab tests and associated covered services to treat COVID-19 diagnosis or symptoms

- Over the counter COVID-19 tests

- COVID-19 related services obtained out-of-network

- Ambulance transportation for members with a COVID-19 diagnosis or symptoms

After May 12, 2023, until further regulatory guidance, MVP will continue to cover COVID-19 vaccines and boosters without cost-sharing and audio-only telehealth visits will be reimbursed in full.

Forms and Plan Information

Your HRA Benefits

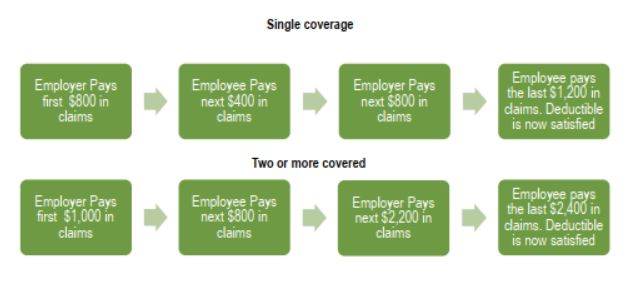

Health Reimbursement Arrangement (HRA) is a promise to reimburse or pay a specific amount toward insurable medical expenses incurred by a participant

One Credit Union will contribute the first $800 for singles or $1,000 for family to cover the cost of deductible expenses.

An additional $800 will be available for single coverage after $400 of employee shared responsibility is satisfied. An additional $2,200 will be available for couple or family coverage after $800 of employee shared responsibility is satisfied.

For 2022, MVP will continue to administer the HRA. Providers will be paid directly from your HRA by MVP when funds are available.

MVP will track claims as they are submitted. When the initial OCU funding is exhausted, employees will be responsible to pay provider for the next either $400 or $800. Once that amount of claims has been submitted, MVP will return to debiting the HRA. While MVP will be tracking HRA usage, it is important for employees to be aware of their available balance.

If you enter the plan at a time other than the beginning of the plan year, the amount credited to your account will be reduced to reflect the time of actual participation.

Eligibility

All full-time employees who work at least thirty (30) hours per week are eligible for coverage the date of hire.

Help Center

(802) 264-6500

Monday- Friday 8:30- 5:00 EST

www.benefitspaymentsystem.com

Select: “Participant Login”

Select: “Create Account”

Forms and Plan Information

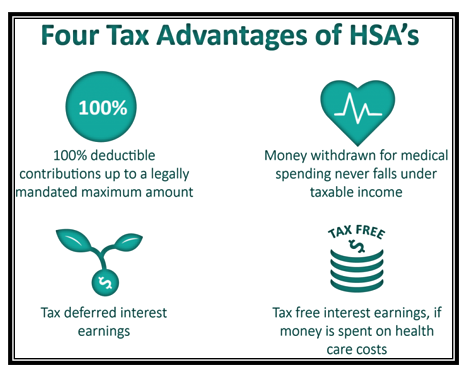

Your HSA Benefits

Employees who elect the Health Savings Account may make a maximum contribution of $3,850 for single coverage and $7,750 for family. These limits include the funding provided by One Credit Union ($40 for individual coverage per paycheck and $80 for all other tiers per paycheck). If you are over the age of 55, you may make an additional contribution of $1,000.

Health Savings Accounts will be managed by MVP Health Care.

Eligibility

All full-time employees who work at least thirty (30) hours per week are eligible for coverage the date of hire.

Help Center

(802) 264-6500

Monday- Friday 8:30- 5:00 EST

www.benefitspaymentsystem.com

Select: “Participant Login”

Select: “Create Account”

Your FSA, LPFSA, and DCA Benefits

My Flexible Spending Account (FSA)

You can pay for unreimbursed medical – including the deductible gap the HRA does not cover – dental , vision, over the counter medical supplied and many more health related expenses on a pre-tax basis. You may deduct up to the IRS maximum annually with up to $500 in unused contributions available to rollover for the next year. If you have a Health Savings Account (HSA) you are unable to enroll in the FSA.

For list of eligible expenses go to www.IRS.gov and search for Publication 502.

Limited Purpose Flexible Spending Account (LPFSA)

Similar to the FSA but limited to reimbursement of Dental and Vision expenses only.

You may deduct up to the IRS maximum limit ($3,050) annually with up to $610 in unused contributions available to rollover for the next year. If you have a Health Savings Account (HSA) you are able to enroll in the LPFSA.

For list of eligible expenses go to www.IRS.gov and search for Publication 502.

Dependent Care FSA

The Dependent Care FSA allows employees to use pre-tax dollars towards qualified dependent care such as caring for children under age 13 or elder care. The annual maximum amount you may contribute to the Dependent Care FSA $5,000 (or $2,500 if married and filing separately) per calendar year.

Examples include:

- The cost of child or adult dependent care

- The cost for an individual to provide care either in or outside your house

- Nursery schools an preschools (excluding kindergarten)

Help Center

(802) 264-6500

Monday- Friday 8:30- 5:00 EST

www.benefitspaymentsystem.com

Select: “Participant Login”

Select: “Create Account”

Forms and Plan Documents

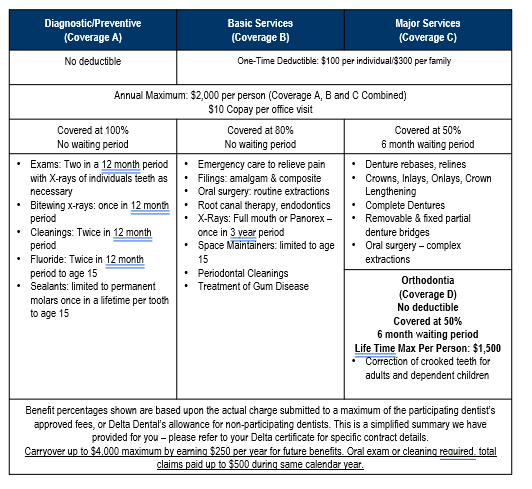

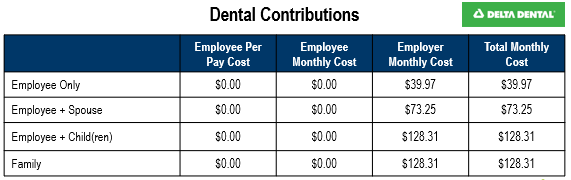

Your Dental Benefits

One Credit Union offers one (1) dental plan to its employees:

Northeast Delta Dental Videos

Contributions

Eligibility

All full-time employees who are scheduled to work 30 or more hours per week are eligible for cover the first of the month following 30 days of employment.

HOW Program Information

Learn how to get the most out of your Delta Dental plan

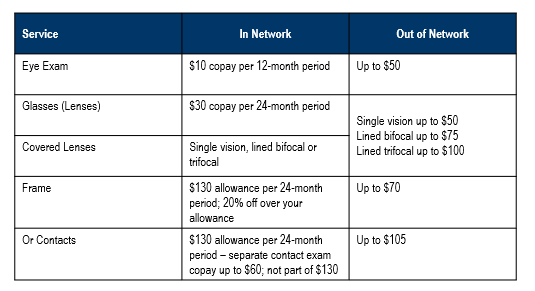

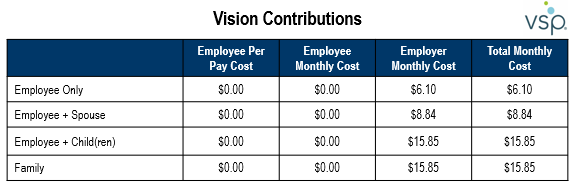

Your Vision Benefits

Your Group Life Benefits

One Credit Union offers Basic Life and Accidental Death & Dismemberment (AD&D) insurance to all eligible employees at 2x your annual earnigs to $200,000. The original benefit is reduced to 65% at age 70 and reduced to 50% at age 75. Benefits terminate at retirement.

Contributions

This is 100% Employer paid.

Eligibility

All full-time employees who work at least thirty (30) hours per week are eligible for coverage the first of the month following 90 days of employment.

Your Short Term Disability Benefits

One Credit Union provides Short Term Disability coverage to eligible employees. This benefit is 66 2/3% of basic weekly pay up to $1,250 maximum. Payment of benefits begins: 1st day of accident and 8th day of illness. The benefit duration is 13 weeks.

Contributions

This is 100% Employer paid.

Eligibility

All full-time employees who work at least thirty (30) hours per week are eligible for coverage the first of the month following 90 days of employment.

Forms

How to File a Claim

There are 3 ways you can file a Short Term Disability Claim. Choose what works best for you.

- Complete the claim form above and mail to Reliance Standard

- Call Reliance Standard at 1-800-351-7500

- Go to www.rsli.com and click “Submit a Claim” under “I am an Employee / Individual“

Your Long Term Disability Benefits

One Credit Union provides Long Term Disability coverage to all eligible emplyees. This benet is 66 2/3% of basic monthly pay up to a maximum of $6,000. Payment of benefits begins after 90 days from start of a qualified disability. The benefit duration is to the normal Social Security Retirement age.

Contributions

This is 100% Employer paid.

Eligibility

All full-time employees who work at least thirty (30) hours per week are eligible for coverage the first of the month following 90 days of employment.

Your Voluntary Colonial Benefits

Financial Protection that fits your needs!

Everyone’s benefit needs are different. That’s why it’s important to choose the benefits that are right for your personal situation.

•Coverage is available for your spouse and eligible dependent

•Benefits are paid directly to you, unless you specify otherwise

•You may received benefits regardless of any other insurance you may have with other insurance companies

Accident Insurance: Helps offset unexpected medical expenses, such as emergency room fees, deductibles and co-payments that can result from a fracture, dislocation or other covered accidental injury

Life Insurance: Enables you to tailor coverage for your individual needs and helps provide financial security for your family members. Special underwriting offers available – no medical questions

Cancer Insurance: Helps offset the out-of-pocket medical and indirect, non-medical expenses related to cancer that most medical plans don’t cover. This coverage also provides a benefit for specified cancer-screening tests

Critical Illness Insurance: Supplements your major medical coverage by providing lump-sum benefit you can use to pay the direct and indirect costs related to a covered critical illness, which can often be expensive and lengthy

Complimentary Identity Theft Protection: No insurance purchase necessary

Contributions

This is 100% Employee paid.

Your Voluntary Reliance Standard Benefits

24 Hour Travel Assistance Service

When traveling more than 100 miles from home or in a foreign country. On Call offers you and your dependents:

- Pre-Trip Assistance

- Emergency Personal Services

- Emergency Medical Transportation

- Medical Services

For emergency medical, legal and travel assistance information and referral service 24 hours a day, 365 days a year, and call U.S. (800) 456-3893 and World Wide (603) 328-1966.

Identity Theft Recovery

To protect you and your family from this devastating loss of time, money and security, Reliance Standard and your employer are provided you with a full service ID Recovery Program that will perform the recovery process for you or a member of your family fall victim to identity theft.

In addition to the recovery program, you also have access to a real-time card monitoring through Wallet Armor. Wallet Armor is an interactive easy-to-use vault for protecting your wallet’s contents, passwords, and important personal documents.

Contributions

This is 100% Employer paid.

Help Center

On Call International – Travel Assistance

U.S. (800) 456-3893

Worldwide (603) 328-1966

Identity Theft Recovery by InfoArmor

(888) 494-8519

Your Employee Assistance Benefits

The Employee Assistance Program by Reliance Standard provides professional and confidential services to help employees and family members address a variety of personal, family, life and work-related issues. From the stress of everyday life to relationship issues or even work-related concerns, the EAP can help with any issue affecting overall health, well-being and life management.

Contributions

This is 100% Employer paid.

Individual Life Insurance Policies

While nothing can replace you, having individual life insurance can protect your loved ones financially. The Richards Group is please to offer a simplified, 100% online solution to get individual life insurance coverage.

- No in-person medical exam necessary

- Just answer a few easy questions about your current health

- View options that fit your needs and budget

- Our AI-powered recommendation engine pulls options from trusted insurance agencies tailored to you and your family’s unique situation needs.

- Select and purchase a plan

- Get qualified instantly, or schedule an online consultation to determine the best fit. No need to wait for open enrollment – your plan is active in just 1-3 weeks from initial selection.

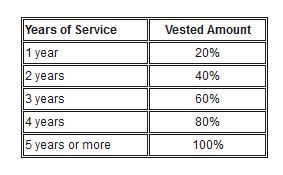

Your Retirement Benefits

One Credit Union sponsors a retirement plan to help you save for retirement. This plan is called a 401 (k) plan. This plan is sponsored by CUNA Mutual Group.

All employees are eligible to participate in the 401 (k) plan after completing 6 months of service. Once eligible, you may begin deferring a portion of your salary up to the IRS annual limit, and your employer will match dollar-for-dollar the amount you contribute up to 3% of your salary. All employer matching dollars are contributed into the 401 (k) plan are on a pre-tax basis, meaning your taxable income is reduced and all contribution and earnings are taxed upon distribution. You can increase or decrease your contributions monthly. Any changes you make will be effective the first of the following month.

You are immediately vested in, meaning your own, 100% of your contributions to the plan.

Contributions

Employer contributions, plus earnings they generate, are vested as follows:

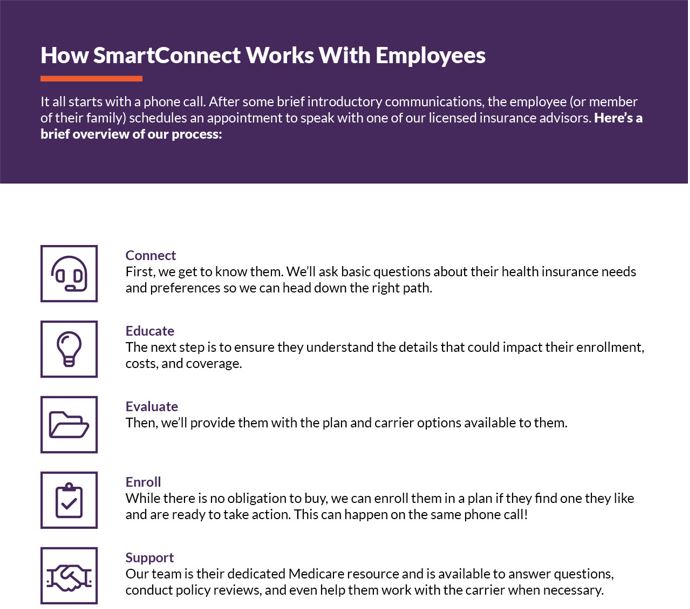

SmartConnect - Medicare Resource

The Richards Group has partnered with SmartConnect™, an exclusive, no-cost program created specifically to connect Medicare-eligible working adults to the world of Medicare benefits. Whether an employee plans to continue working or is transitioning to retirement, we tailor solutions designed around their needs. Our agents provide an unfiltered view of the entire range of options and prices available to the employee.

SmartConnect Contact Information

For more information or to get started, please click on the following link:

Additional Information

Your Tuition Assistance

The One Credit Union’s tuition assistance program is designed to help employees pay back student loan debt and improve their financial well-being.

Utilizing One Credit Union’s relationship with The Richards Group, consultation services provided through GradFin are provided free of charge. GradFin is a new employee benefit program that is revolutionizing the way employees can reduce their student loan debt.

GradFIN will provide:

- One-on-one education consultations with GradFin Consultation Experts to review your current loan status and discuss personalized payoff options to save on your loans.

- GradFin will offer a competitive interest rate reduction when you refinance your loans.

- GradFin will offer the lowest interest rates in the industry through their lending platform which is made up of ten lenders to maximize the chances that you will be approved for a new loan.

For more information or to schedule a one-on-one consultation visit:

Help Center

GradFIN

For more information or to schedule a 15-minute appointment with a GradFin Consultation Expert click HERE!

Phone: (844) GRADFIN

Plan Information

Your MemberDeals Discounts

One Credit Union employees have now access to huge savings on nationwide entertainment through MemberDeals. Find exclusive discounts, special offers, preferred seating, and tickets to top attractions, theme parks, shows, sporting events, hotels and much more.

- Save up to 40% on Top Theme Parks Nationwide

- Save up to 60% on Hotels Worldwide

- Save up to 40% on Top Las Vegas & Broadway Show Tickets

- Huge Savings on Disney & Universal Studios Tickets

- Preferred Access Tickets™ Find great seats to your favorite concerts, sports and more!