2025

Benefits at a Glance

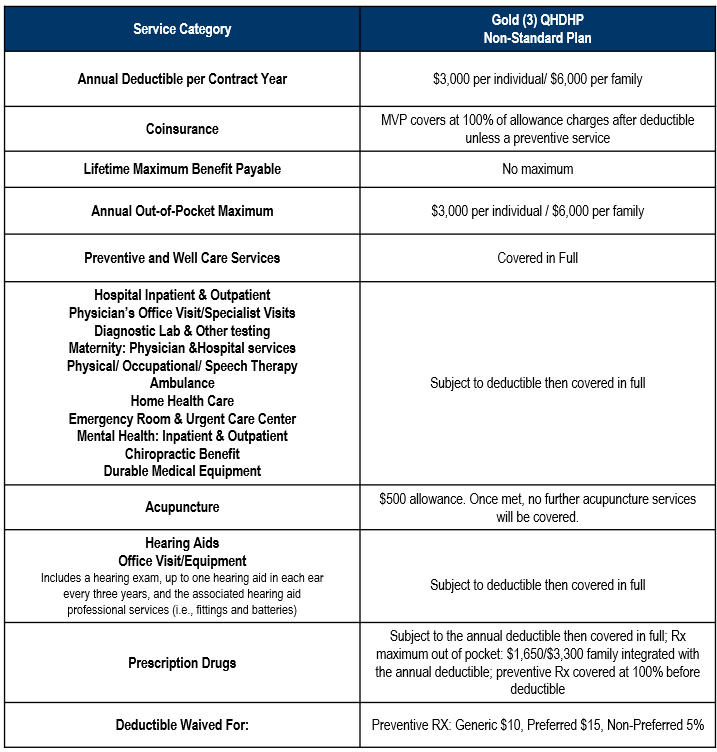

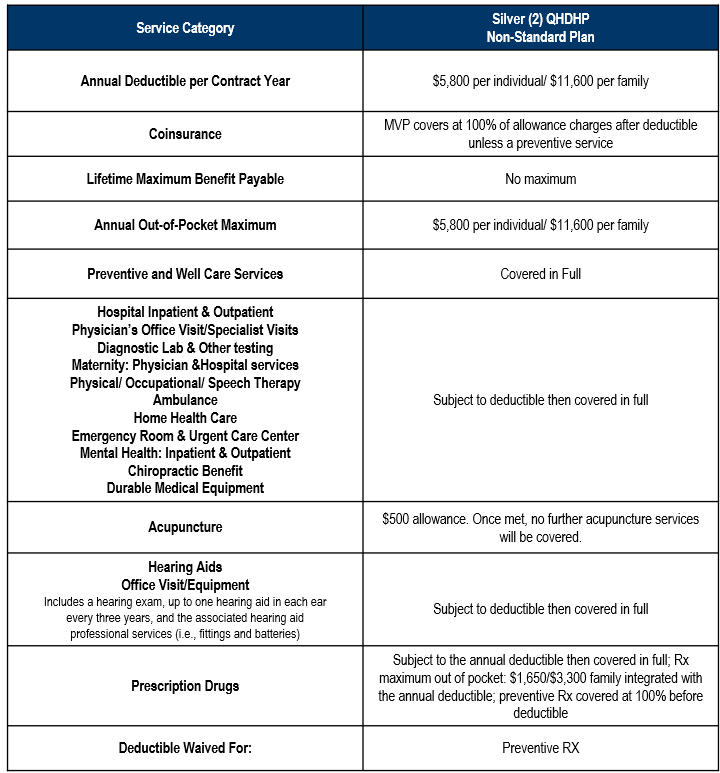

Your Medical Benefits

One Credit Union offers one (2) medical plans to its eligible employees. Coverage is provided through MVP Health Care. Below is information on the benefits.

Summary of Benefits and Coverages

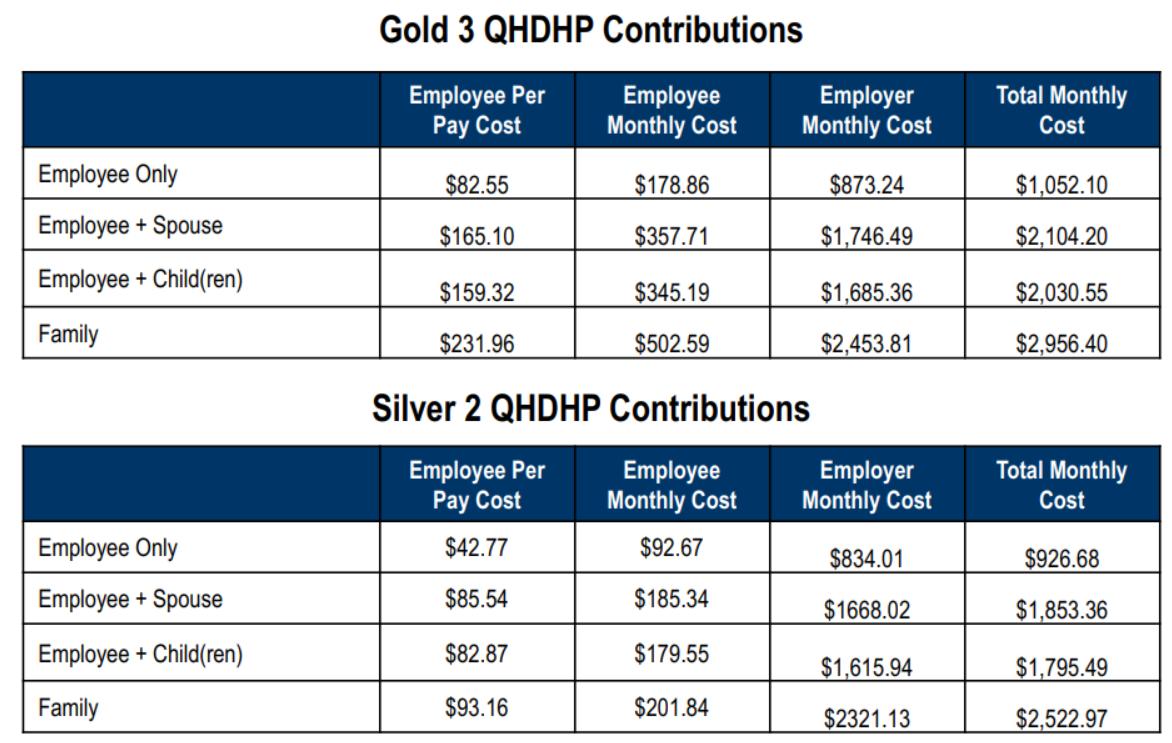

Contributions

Eligibility

Eligibility is date of hire for employees scheduled to work 30 or more hours per week. One Credit Union will pay 83% of the premium. Employees declining coverage will need to complete a waiver of group health insurance benefits form.

Forms and Plan Information

Discount Programs for Weight Loss

Your HRA Benefits

A Health Reimbursement Arrangement (HRA) is a promise to reimburse or pay a specific amount toward insurable medical expenses incurred by a participant

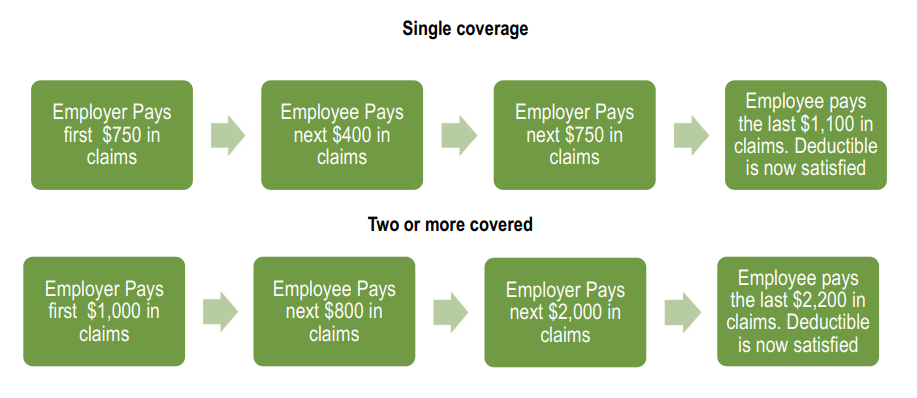

One Credit Union will contribute the first $750 for singles or $1,000 for family to cover the cost of deductible expenses.

An additional $750 will be available for single coverage after $400 of employee shared responsibility is satisfied. An additional $2,000 will be available for couple or family coverage after $800 of employee shared responsibility is satisfied. Once the second portion of the Employer HRA is used, the Employee is responsible for the balance of the deductible, which is $1,100 for single coverage and $2,200 for family coverage.

For 2025, MVP will continue to administer the HRA. Providers will be paid directly from your HRA by MVP when funds are available.

MVP will track claims as they are submitted. When the initial OCU funding is exhausted, employees will be responsible to pay provider for the next either $400 or $800. Once that amount of claims has been submitted, MVP will return to debiting the HRA. While MVP will be tracking HRA usage, it is important for employees to be aware of their available balance.

If you enter the plan at a time other than the beginning of the plan year, the amount credited to your account will be reduced to reflect the time of actual participation.

Eligibility

All full-time employees who work at least thirty (30) hours per week are eligible for coverage the date of hire.

Help Center

(802) 264-6500

Monday- Friday 8:30- 5:00 EST

www.benefitspaymentsystem.com

Select: “Participant Login”

Select: “Create Account”

Forms and Plan Information

Your HSA Benefits

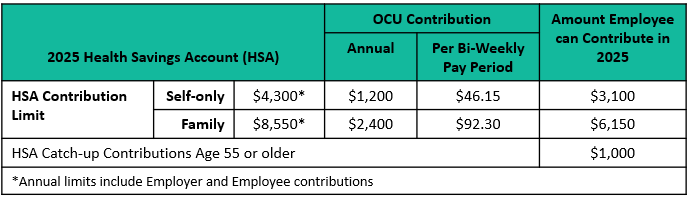

Employees who elect the Health Savings Account may make a maximum contribution of $4,300 for single coverage and $8,550 for family. These limits include the funding provided by One Credit Union ($40 for individual coverage per paycheck and $80 for all other tiers per paycheck). If you are over the age of 55, you may make an additional contribution of $1,000.

Health Savings Accounts will be managed by MVP Health Care.

Eligibility

All full-time employees who work at least thirty (30) hours per week are eligible for coverage the date of hire.

Help Center

(802) 264-6500

Monday- Friday 8:30- 5:00 EST

www.benefitspaymentsystem.com

Select: “Participant Login”

Select: “Create Account”

Your FSA, LPFSA, and DCA Benefits

My Flexible Spending Account (FSA)

You can pay for unreimbursed medical – including the deductible gap the HRA does not cover – dental, vision, over-the-counter medical supplies and many more health-related expenses on a pre-tax basis. You may deduct up to the IRS maximum of $3,300 for 2025, with up to $660 in unused contributions available to rollover for the next year. If you are enrolled in an HSA, you can enroll in a Limited-Purpose FSA (vision and dental expenses only).

For a list of eligible expenses, go to www.IRS.gov and search for Publication 502.

Limited Purpose Flexible Spending Account (LPFSA)

Similar to the FSA but limited to reimbursement of Dental and Vision expenses only.

You may deduct up to the IRS maximum limit of $3,300 for 2025, with up to $660 in unused contributions available to rollover for the next year. If you have a Health Savings Account (HSA) you are able to enroll in the LPFSA.

For a list of eligible expenses, go to www.IRS.gov and search for Publication 502.

Dependent Care FSA

The Dependent Care FSA allows employees to use pre-tax dollars towards qualified dependent care such as caring for children under age 13 or elder care. The annual maximum amount you may contribute to the Dependent Care FSA $5,000 (or $2,500 if married and filing separately) per calendar year.

Examples include:

- The cost of child or adult dependent care

- The cost for an individual to provide care either in or outside your house

- Nursery schools an preschools (excluding kindergarten)

Help Center

(802) 264-6500

Monday- Friday 8:30- 5:00 EST

www.benefitspaymentsystem.com

Select: “Participant Login”

Select: “Create Account”

Forms and Plan Documents

FSA/HSA Store

The Richards Group has entered into a partnership with Health-E Commerce, also known as the FSA/HSA Store. This gives you access to hundreds of products that have been pre-vetted & approved for use with your Flexible Spending or Health Savings Accounts.

Did you know you could use your FSA/HSA to save money on everyday health essentials like baby health items, health trackers, pain relief products and more?

Here are just a few benefits of using the FSA/HSA Store:

- No Receipts Needed

- 2,500+ FSA Eligible Products

- 100% Eligibility Guaranteed

- Skip the claims process when you use your FSA/HSA card

This partnership also allows access to their Caring Mill products. Caring Mill is a line of premium healthcare products that support a healthy lifestyle and on average is priced 30% less than branded equivalent products.

With every Caring Mill purchase, a donation is made to Children’s Health Fund, providing necessary treatments to thousands of children in need, throughout the United States.

Curious what your FSA/HSA dollars can cover? Simply enter the product you are looking for in the eligibility list below.

To access the FSA Store please visit: https://fsastore.com

To access the HSA Store please visit: https://hsastore.com

Forms and Plan Documents

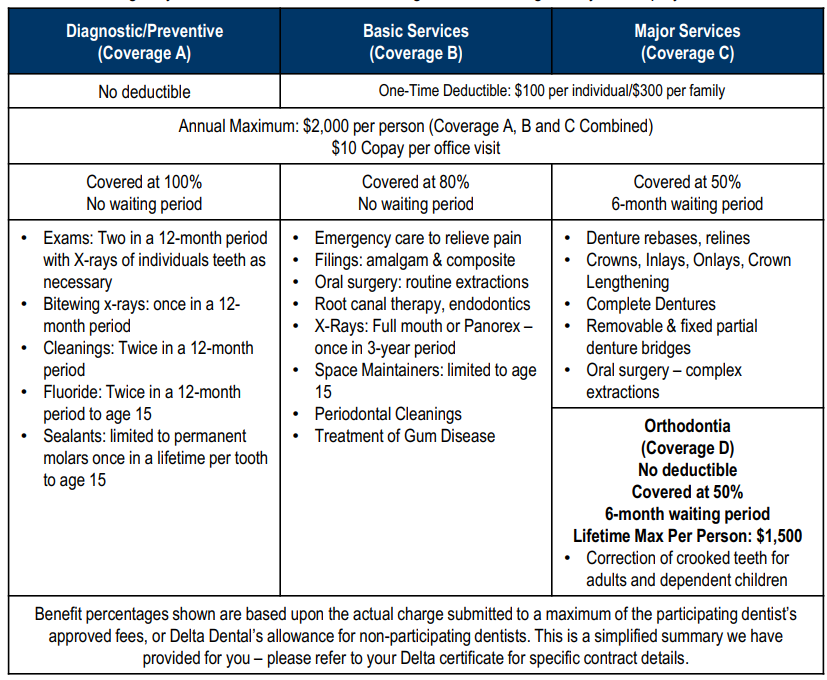

Your Dental Benefits

One Credit Union offers one (1) dental plan to its employees:

Northeast Delta Dental Videos

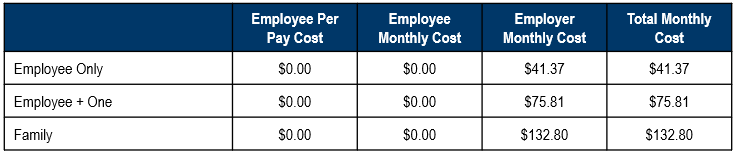

Contributions

Eligibility

All full-time employees who are scheduled to work 30 or more hours per week are eligible for cover the first of the month following 30 days of employment.

HOW Program Information

Learn how to get the most out of your Delta Dental plan

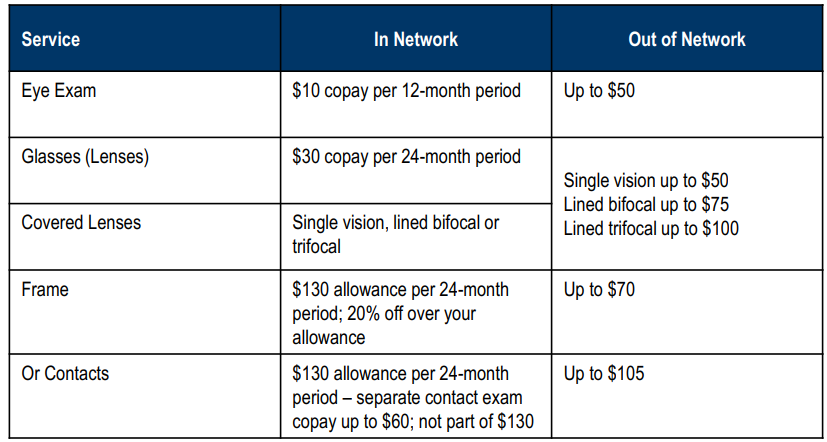

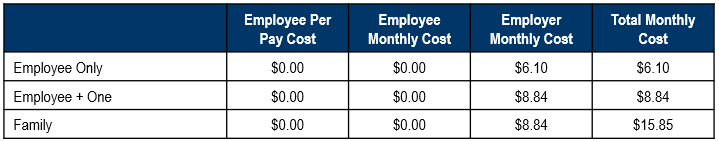

Your Vision Benefits

Your Group Life Benefits

One Credit Union offers Basic Life and Accidental Death & Dismemberment (AD&D) insurance to all eligible employees at 2x your annual earnings to $200,000. The original benefit is reduced to 65% at age 70 and reduced to 50% at age 75. Benefits terminate at retirement.

Contributions

This is 100% Employer paid.

Eligibility

All full-time employees who work at least thirty (30) hours per week are eligible for coverage the first of the month following 90 days of employment.

Your Short Term Disability Benefits

One Credit Union provides Short Term Disability coverage to eligible employees. This benefit is 66 2/3% of basic weekly pay up to $2,000 maximum. Payment of benefits begins: 1st day of accident and 8th day of illness. The benefit duration is 13 weeks.

Contributions

This is 100% Employer paid.

Eligibility

All full-time employees who work at least thirty (30) hours per week are eligible for coverage the first of the month following 90 days of employment.

Your Long Term Disability Benefits

One Credit Union provides Long Term Disability coverage to all eligible emplyees. This benet is 66 2/3% of basic monthly pay up to a maximum of $10,000. Payment of benefits begins after 90 days from start of a qualified disability. The benefit duration is to the normal Social Security Retirement age.

Contributions

This is 100% Employer paid.

Eligibility

All full-time employees who work at least thirty (30) hours per week are eligible for coverage the first of the month following 90 days of employment.

Your Voluntary Mutual of Omaha Benefits

Voluntary Accident Insurance

Don’t let an accident catch you off guard. Protect your family’s finances with Accident Insurance from United of Omaha Life Insurance Company.

An accident insurance policy supplements your medical coverage and provides a cash benefit for injuries you or an insured family member sustain from an accident.

Voluntary Critical Illness

As an active employee of One Credit Union, you can lessen the financial impact of a serious illness by purchasing Critical Illness insurance through United of Omaha Life Insurance Company.

A critical illness insurance policy provides a lump-sum cash benefit upon diagnosis of a critical illness like a heart attack, stroke or cancer. This benefit can be used to pay out-of-pocket expenses or to supplement your daily cost of living.

Voluntary Term Life Insurance

As an active employee of One Credit Union, you have access to a life insurance policy from United of Omaha Life Insurance Company. It replaces the income you would have provided, and helps pay funeral costs, manage debt and cover ongoing expenses.

Contributions

This is 100% Employee paid.

Your Travel Assistance Benefits

24 Hour Travel Assistance Service

Travel Assistance through Mutual of Omaha, provided by AXA Assistance, can help you, your spouse and dependent children on any single trip up to 120 days in length and more than 100 miles from home:

- Pre-Trip Assistance

- Immediate Attention For Emergencies While Traveling

- Emergency Travel Support Services

- Medical Assistance

- Identity Theft

- Education and Prevention

- Recovery Information

For inquiries within the U.S. call toll free: 1-800-856-9947

Outside of the U.S. call collect: (312) 935-3658

Contributions

This is 100% Employer paid.

Your Employee Assistance Benefits

The Employee Assistance Program by Mutual of Omaha allows you to get the help you need so you can spend less time worrying about the challenges in your life and can get back to being the product worker your employer counts on to get the job done.

Contributions

This is 100% Employer paid.

Your Will Preparation Services

Epoq Inc. offers a secure account space that allows you to prepare wills and other legal documents. Whether you are single, married, have children or are a grandparent, a will is an important investment in your future and should be tailored for your life situation.

Create your will at www.willprepservices.com and use the code MUTUALWILLS to register

Your Retirement Benefits

One Credit Union sponsors a retirement plan to help you save for retirement. The Plan is called a 401 (k) Plan. This Plan is sponsored by CUNA Mutual Group.

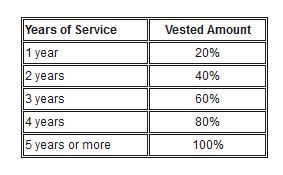

All employees are eligible to participate in the 401(k) plan after completing 6 months of service. Once eligible, you may begin deferring a portion of your salary up to the IRS annual limit. One Credit Union contributes to the plan in two ways. The first is a Safe Harbor Non-Discretionary contribution that is a flat 3% that is automatically contributed to all eligible employees’ accounts regardless of personal contribution level; and you do not need to participate in the 401k plan to partake in this 3% contribution. The second is a match contribution that is 100% match on the first 3% of the employee contribution. All employee contributed dollars to the 401(k) plan are on a pre-tax basis with the exception of contributions to the Roth Ira option of the plan, which is an after-tax deduction. The pretax contribution reduces your taxable income and all contributions and earnings are taxed upon distribution. The after-tax contribution does not reduce your taxable income, however only earnings are taxed upon distribution. You can increase or decrease your contributions on a per payroll basis.

You are immediately vested in, meaning you own, 100% of your contributions and the Safe Harbor contributions to the plan. Employer Match contributions, plus earnings they generate, are vested as follows:

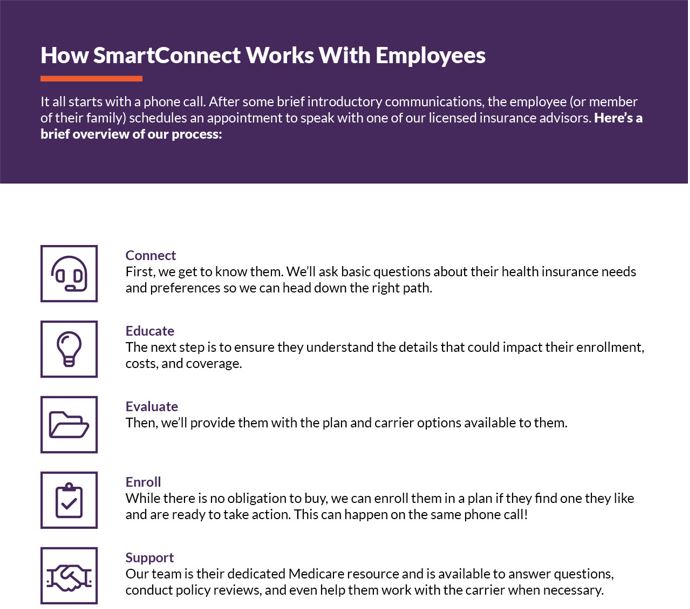

SmartConnect – Medicare Resource

The Richards Group has partnered with SmartConnect™, an exclusive, no-cost program created specifically to connect Medicare-eligible working adults to the world of Medicare benefits. Whether an employee plans to continue working or is transitioning to retirement, we tailor solutions designed around their needs. Our agents provide an unfiltered view of the entire range of options and prices available to the employee.

SmartConnect Contact Information

Phone: 1-833-502-2747 TTY 711

For more information or to get started, please click on the following link:

Additional Information

Your Tuition Assistance

The One Credit Union’s tuition assistance program is designed to help employees pay back student loan debt and improve their financial well-being.

Utilizing One Credit Union’s relationship with The Richards Group, consultation services provided through GradFin are provided free of charge. GradFin is a new employee benefit program that is revolutionizing the way employees can reduce their student loan debt.

GradFIN will provide:

- One-on-one education consultations with GradFin Consultation Experts to review your current loan status and discuss personalized payoff options to save on your loans.

- GradFin will offer a competitive interest rate reduction when you refinance your loans.

- GradFin will offer the lowest interest rates in the industry through their lending platform which is made up of ten lenders to maximize the chances that you will be approved for a new loan.

For more information or to schedule a one-on-one consultation visit:

Help Center

GradFIN

For more information or to schedule a 15-minute appointment with a GradFin Consultation Expert click HERE!

Phone: (844) GRADFIN

Plan Information

Your MemberDeals Discounts

One Credit Union employees have now access to huge savings on nationwide entertainment through MemberDeals. Find exclusive discounts, special offers, preferred seating, and tickets to top attractions, theme parks, shows, sporting events, hotels and much more.

- Save up to 40% on Top Theme Parks Nationwide

- Save up to 60% on Hotels Worldwide

- Save up to 40% on Top Las Vegas & Broadway Show Tickets

- Huge Savings on Disney & Universal Studios Tickets

- Preferred Access Tickets™ Find great seats to your favorite concerts, sports and more!